Process of Importing a Car to Kenya | step by step guide

When buying a car in Kenya, there are different options that you have, among them is importing from abroad markets such as Japan. Here, we will provide you with a simple step-by-step guide on how you can import a car from Japan, the advantages of importing, the risks involved and the cost overview.

Note: This article is long, however, we recommend you to go through every section of it to equip yourself with the right information regardless of whether you will involve someone else to do the importation on your behalf.

It is important to note that you can import both used and new cars in Kenya. For used cars, the maximum age is seven years, so, if we are in 2022, you can only import 2015 models of used cars coming forward. New cars are straight from the manufacturer and they come at a higher price.

A common misconception among Kenyans is that a new number plate means a new car, this is wrong if the car was used abroad. In fact, the highest percentage of imported cars in Kenya are secondhand, this is because new cars come at a very high cost which might not be affordable to most.

Step by step guide of importing a car from Japan to Kenya by your Own

When getting a car, the first thing you should do is detailed research on the car you want. This will give you a clear understanding of whether the car fits your budget(both buying and maintenance), whether it is suitable for your intended purpose, features of the car and other alternatives you may have. You can check a detailed review, insights and specifications of any car over here.

Where to import

Now, after you have done the market research of the car and you decided which to go for, it’s time to start the import process. Follow the steps below to import your car to Kenya.

- Identify a cars’ importing website to use- the import process is usually done online, there are different reputable popular sites that one can use such as SBT Japan, Be Foward, Carfrom Japan and others. There are more sites that you can use, just make sure that they have a good reputation

- Now, search for the car name and model you picked using the site’s search and filter features

- You will be presented with cars available for importation. Pick the one within your budget.

- Note: The prices indicated on this importation site do not include taxes. They only involve the buying price and the transportation fee to Mombasa port. This amount is Known as Cost Insurance Freight(CIF).

Getting the total cost of the car

To get the total cost including taxes, follow the steps below:

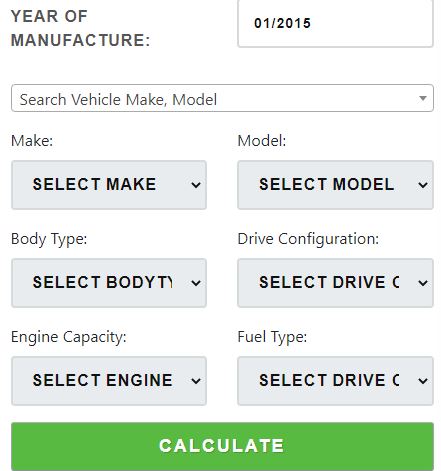

- Go to the KRA import duty calculator through this Link

- Here, you will be required to enter the vehicles year of manufacture and model, the details can be found on the features list of the car

- Next, click on Calculate and you will get the total Taxes and Levies

- To get the total cost of the vehicle, add the CIF price from the importation site with the Taxes and Levies

Purchasing and shipping of the car

If the cost is within your budget and you are satisfied with the features plus condition as seen in the photos, go ahead and start the buying process.

- To purchase, you will need an account on the site, go ahead and create one

- Now, bargain the price with the seller who is offering the car on the site, you might get it at a slightly lower price

- Once agreed, click on Buy now or the purchase button on the particular site. Go ahead and make the payment(this can be 100% or 60% of the CIF)

- Please note, you will have to change the currency from Kenya shillings to dollars(in the bank) for the payment to go through

- An inspection of the car is now done( all cars imported to Kenya must be inspected either at the port of Mombasa or before importation. The inspection certificate will be sent to you

- After the inspection is done, the shipping will begin. You will receive a bill of lading. This is used to track the shipping process and helps in clearing the car at the port

- Goods must be cleared in the port, the clearing process of cars can only be done by clearing agents/companies according to the laws of Kenya

- Hence, one should pick a reputable clearing agent and give them the bill of lading even before the car arrives so that they can prepare for the clearing process

The clearing process of the car in Mombasa port

After the car arrives in Mombasa(takes 2 weeks to 6 weeks in normal global shipping chain conditions), your agent will start the clearing process after you paid them the clearance fee. Here is what you will have to do with the help of the clearing agent:

- First, pay all the Taxes and Levies(duty) to KRA

- After clearing the duty, the car can now be registered on the NTSA portal

- Port charges will also have to be cleared

- You will then receive your logbook after 2 weeks or so

- When clearing is done and you have a number plate. Pay the insurance for the vehicle(comprehensive insurance is recommended)

- Now, you can drive your car from the port or have it transported to your location(you will incur the cost)

The clearing process can take up to 10 days.

Documents needed for the clearance

Since the clearance will involve the vehicle being registered to the owner by NTSA and KRA, there are documents that you should provide

- Your National Identification(ID)

- KRA pin

- 2 copies of the Bill of lading

- The inspection certificate

- An account on the NTSA rims portal

That is it, you will now have you will now vehicle.

Advantages of importing a car to Kenya

The main advantage that comes with importing your car instead of buying from local dealers is the amount you will save. You can save up to 20% when you import your car. Dealers will always want profits plus other costs such as security services payment, yard payment, car wash and similar costs. All this is usually pushed to the client but when importing, there is no such.

Additionally, an imported car has a higher probability of being in a better condition than the ones used locally. Since you are importing from first world countries, the car was been driven in better roads and not to mention the stricter regulations there that ensure the car is always roadworthy.

Risks of importing a car to Kenya

The major risk of importing the car is losing your cash to fraudsters. As you noted, the sellers or suppliers will require you to pay a part or all the amount of CIF(Cost Insurance Freight). You are sending cash to someone overseas who is selling you a product that you have seen only in photos, this is a high-risk situation. For this reason, one should do due diligence and be very careful. If you are not sure, use an importing agent/dealer.

One disadvantage is that you will have to wait. For locally available cars, you buy and drive, when it comes to imported cars however, you can wait up to 2 months. This can get worse if global shipping is disrupted or when there are delays on the port.

Cost of importing a car to Kenya

One thing that you should note when importing a car is that there are good months and bad months. The bad months are in relation to the taxes, they depend on when a car was first registered(abroad) and the current month we are in. For example, a Toyota Vitz 1300cc registered in October 2015 might have higher taxes of maybe KSh 70,000 compared to another of the same specs registered in January 2015. To understand this, you can watch this video(at the end).

Cost Insurance Freight(CIF)

The CIF is a term used to describe a total of the Buying fees, the transporting insurance fee and the shipping fee. Once you pay this, the seller/company is responsible for shipping the car to the nearest port to you. in this case, Mombasa port. Just like you would expect, the cost varies with regard to the car make, model, trim, condition and seller. This amount is paid in full before the shipping begins.

Import Duty fee

This is the amount paid to Kenya Revenue Authority(KRA). The import duty fee will also increase with how recent the car is, its make, model and features. This amount is paid once the car arrives at the port.

NTSA fee

To get your logbook and number plate, you will have to pay a certain amount to the NTSA. This amount will change depending on your vehicle’s make and features.

Clearance fee

This is the amount that you will pay to your clearing agent at the port. The amount can be paid before or after the process depending on how you agree with the agent. The amount starts from Ksh 6,000 going upwards.

Insurance cover

For any car to drive on Kenyan roads, it must have insurance cover. You can choose between a comprehensive insurance cover and a 3rd part insurance cover. A comprehensive is recommended since it covers everything, unlike the 3rd party that covers other people and property involved in an accident except the vehicle and owner. The comprehensive is however expensive.

FAQs about importing a car to Kenya

[sp_easyaccordion id=”15149″]

Above is a look at the process of importing a car to Kenya. Cheers!!